The informational session began with a case scenario involving a 40 year-old female with a typical household income and average retirement savings. This person was struggling to establish sufficient entrepreneurial funds using traditional methods, which prompted the question “is there a more efficient way to invest in a startup?”

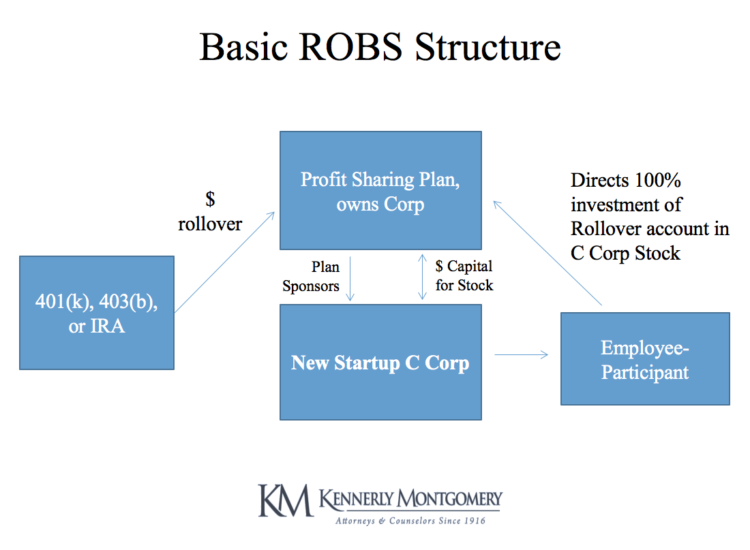

When properly structured, ROBS allow entrepreneurs to utilize funds from their 401(k) or other tax-advantaged retirement account to fund a new business (or franchise), buy an existing business, or recapitalize an existing business. ROBS also allows for these funds to be used before a person reaches the age of 59 ½ without paying the usual income taxes and early withdrawal penalties. *There are benefits, but ROBS are highly technical and fraught with potential pitfalls and speed bumps as well as a strong risk of scrutiny from the IRS and DOL.

When properly structured, ROBS allow entrepreneurs to utilize funds from their 401(k) or other tax-advantaged retirement account to fund a new business (or franchise), buy an existing business, or recapitalize an existing business. ROBS also allows for these funds to be used before a person reaches the age of 59 ½ without paying the usual income taxes and early withdrawal penalties. *There are benefits, but ROBS are highly technical and fraught with potential pitfalls and speed bumps as well as a strong risk of scrutiny from the IRS and DOL.

Ongoing Requirements Related to a ROBS Business, Potential Hurdles and Pitfalls, and the IRS

A side-by-side tax implication comparison between ROBS and a traditional approach revealed that the would-be entrepreneur could have access to 50% more investment cash with ROBS. Although it was noted that this increase could potentially come at a high, complex cost to the individual.

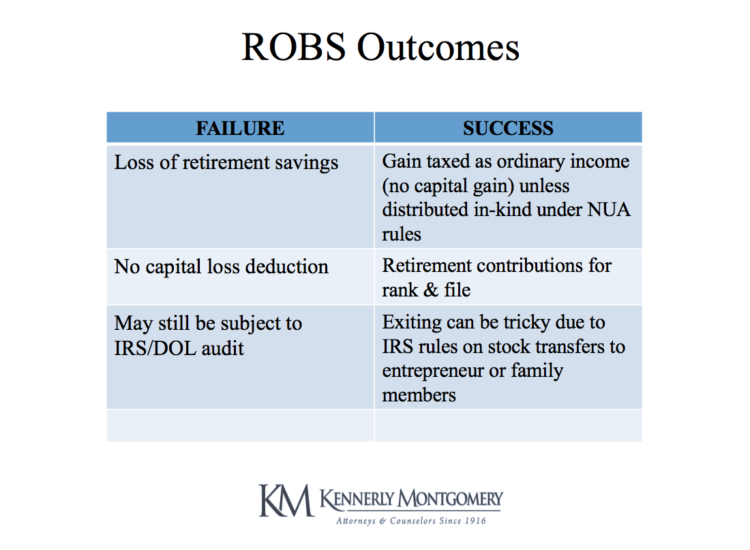

Multiple technical requirements of Rollover Business Startups were explained including conflicts of interest, tax information, exceptions, and operation requirements. An IRS Audit scenario pointed out the possible outcomes that entrepreneurs could face including loss of retirement savings, no capital loss deduction, and the possibility of being subjected to IRS/DOL audits. Additional information was shared about exiting ROBS and reasons NOT to use ROBS, such as:

Multiple technical requirements of Rollover Business Startups were explained including conflicts of interest, tax information, exceptions, and operation requirements. An IRS Audit scenario pointed out the possible outcomes that entrepreneurs could face including loss of retirement savings, no capital loss deduction, and the possibility of being subjected to IRS/DOL audits. Additional information was shared about exiting ROBS and reasons NOT to use ROBS, such as:

- Use up (lose) retirement savings

- Diversity of investment versus having all your eggs in one basket

- No capital gains; gains taxed at ordinary rates under most circumstances

- This tax implication cannot be avoided when using ROBS except pursuant to NUA rules

- IRS/DOL hassle

- Audits are a strong possibility

- Cost of appraisal annually

- This MUST be done annually

- Higher fees for lawyers and accountants, and additional fees for ROBS promoters and administrators

- Potential loss of equity as employees participate in the Profit Sharing Plan

Options and alternatives for financing startups using IRAs and qualified plans

Another way to find investment money for a startup involves using mom’s 401(k) or IRA; plan loan, hardship distribution, distribution, or a participant directed account. Lastly, other alternatives were discussed involving Employee Stock Ownership Plans (ESOP) and Qualified Plan Investing in Qualifying Employer Real Estate.

Additional Information about Kennerly Montgomery

Kennerly Montgomery is a general practice law firm that has provided legal advice to clients for 100 years. KM attorneys practice in a variety of areas, representing private employers, non-profits, and municipal clients, including local governments, agencies and public utilities. Bill Mason, Kathy Aslinger, and Zack Gardner practice extensively in employment and employee benefits law, which includes advising employers on individual employee issues, employment contracts, employee handbooks, as well as design, documentation, administration, audit, litigation, termination and qualification of employee health and welfare and pension plans for public, tax exempt and private employers. They represent clients before various agencies regulating employment issues and employee benefits.